By Bill Webb, Word&Way Editor

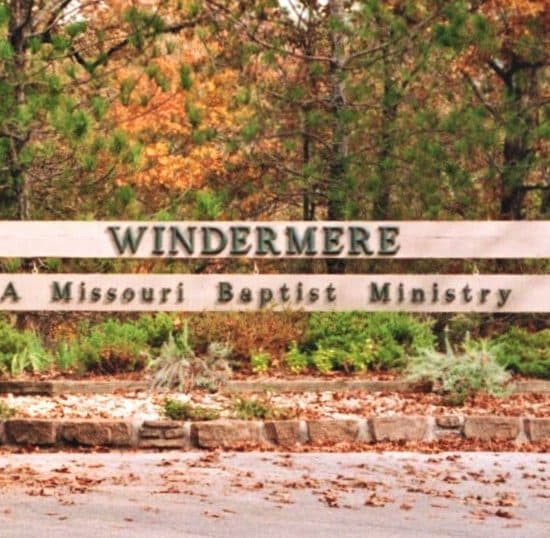

Jefferson City — Judge Thomas Brown granted a preliminary injunction June 1 that prohibits Windermere Baptist Conference Center from the sale or transfer of property or timber or incurring further debt secured by real estate without court approval.

But the Cole County Circuit Court judge said the sale of 941 acres of Windermere property in November 2005 would stand and is not affected by his order. He also denied a request by the Missouri Baptist Convention Executive Board, the plaintiff in the action, to prohibit the sale of mortgage bonds that were part of a debt-restructuring plan that prompted the land sale.

Missouri Baptist Convention attorneys were granted a temporary restraining order on Dec. 19 after objecting to the November sale of property and the ongoing sale and removal of timber on the land. Subsequent hearings set for Feb. 15, Feb. 28, April 10 and May 9 were delayed because convention attorneys said they needed more time to collect information and take depositions in the matter.

Convention attorneys argued against a sentence in Judge Brown's order that specifically states Windermere, California Plan (the entity that holds the bonds) and anyone acting on their behalf may sell, assign or transfer interest in the mortgage bonds. But the judge said a successful bond sale was in the best interests of all involved.

“At this moment, [the sale of bonds] best protects the assets of Windermere,” Judge Brown responded. “In the event the plaintiffs prevail [in their effort to regain the right to elect Windermere's trustees], the sale of the bonds will be in the best interests [of the convention].”

During the June 1 hearing, attorneys for the plaintiffs entered 16 exhibits while Windermere attorneys entered 25 and called Windermere's trustee chair and its acting executive director to the witness stand.

Board chair Bob Plunk, retired chairperson, president and CEO of GuideOne, a major casualty and life insurer for Christian denominations and institutions, and a founding director of Mothers Against Drunk Driving, described the necessity of Windermere restructuring a $20-plus million debt and subsequently transferring title of 941 of its nearly 1,300 acres of property adjoining the Lake of the Ozarks.

Plunk, a member of the Windermere board of trustees since 2004, said the original indebtedness was incurred to complete Lakeview Lodge, to construct the Wilderness Creek Camp addition and to upgrade the conference center's water treatment system. All the money was used for the development of Windermere, he testified.

But Windermere reached a point when it was unable to make payments on the loan, Plunk told the court.

“Part of the reason was that we were unable to finish Wilderness Creek and unable to use all of the space,” Plunk said. In addition, the original bank, Allegiant, had been sold to National City Bank of Cincinnati, and Windermere found itself relating to new loan personnel.

In addition, the conference center faced active interference, he noted.

“Letters were written trying to discourage attendance at Windermere. That was disparaging from a business perspective,” he testified, saying it was his opinion that such maneuvering and attempts to thwart financing efforts constituted “tortuous interference with business.”

As a result, Windermere had accumulated more than $1 million in unpaid interest on its initial $19 million loan, he said. Windermere trustees continued to seek ways to reduce their debt, Plunk said.

“We were headed toward eventual foreclosure that would have happened” had trustees not arranged their most recent refinancing plan, he said.

The idea of transferring title to a portion of undeveloped Windermere property surfaced as talks progressed between Windermere and the lender, Plunk said.

Windermere's goal in seeking a remedy was “to make the refinancing work and bring us into a manageable program,” he explained, adding that the refinancing plan enabled Windermere trustees to approve what is believed to be the first balanced budget ever for the conference center.

The 941 acres Windermere subsequently transferred to the bank were appraised at $3.5 million, Plunk said. National City Bank agreed both to discount the loan by $4.5 million and to purchase the property for $6.5 million — more than double the appraised value.

“We are not developers,” Plunk said of Windermere. “We would never have developed that [941 acres of land].”

Still, Windermere's “master plan as it unfolded was to sell off portions of land” and in turn provide the infrastructure to service private home or retirement home developments on the property.

“We own the water tower, the water treatment system and the roads,” he said. It will be less expense for a developer to pay to expand Windermere's water treatment plant that to build a new one. “Windermere would benefit from that.”

Windermere also planned to provide conference center volunteer opportunities for residents of development adjacent to Windermere, he added.

In his testimony, Dan Bench, Windermere's acting executive director, said the loan enabled the conference center in its 2005 audit to reverse its financial picture to about $6 million in positive assets from a year earlier, when it showed negative assets of under $500,000.

The judge's order was the latest in legal proceedings that began when the MBC took action against Windermere, Word&Way, The Baptist Home, Missouri Baptist University and the Missouri Baptist Foundation on Aug. 13, 2002.

Trustees of The Baptist Home changed the entity's charter in 2000 to allow them to elect their own board members. The other four institutions did the same thing in 2001.