If the payday lending industry and other short-term credit options, such as car title or signature loans, are curtailed or shut down, consumers may have only a few other options.

Community and faith-based groups face that argument when they seek to reform what many have dubbed “predatory” lending because of triple-digit interest rates such loans sometimes command.

Citing a study by the University of Chicago, the industry claims payday and similar loans are necessary to assist consumers, particularly in emergencies. The option can “significantly” reduce the number of foreclosures filed following a natural disaster, the study says.

Restricting the industry also would discourage others from offering new credit products, Steven Schlein, a spokesperson for the payday advance trade group Community Financial Services Association of America, said.

Other lending options are available, although most are small or restricted to a particular group or geographic area. In the last few years, however, more possibilities have sprung up, with even the Federal Deposit Insurance Corporation (FDIC) offering suggestions to its member banks.

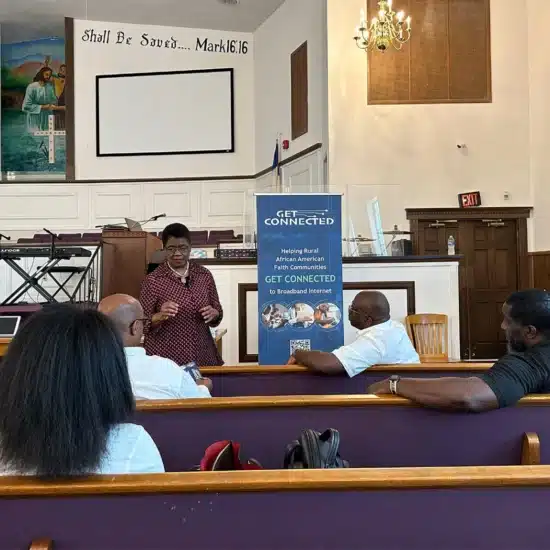

Used overseas for several years, micro-lending can meet needs stateside, particularly in specific communities. Lydia House, a faith-based transitional housing program for survivors of domestic abuse and their children, offers small micro-loans to clients who need assistance for transportation or job readiness.

Although restricted to members, some credit unions now offer short-term loans with lower interest rates than most payday advance companies. State Employees’ Credit Union in North Carolina grants small loans at 12 percent interest, and the program includes a savings component. Virginia Methodist Credit Union has provided loans through its Jubilee Assistance Fund.

Some community faith-based organizations are partnering with local banks to provide small loans. Communities Creating Opportunities, a faith-based organizing network in Kansas City, recently launched Fair Community Credit.

The program does not make direct loans but provides collateral to a local bank for small-dollar loans, usually from $300 to $2,500. Its maximum interest rate is set at 36 percent, with repayment from four to 24 months.

Fair Community Credit staff screen applicants and guarantee payment if a borrower defaults. The program issued its first loan in January.

In the last four years, the FDIC has conducted two studies focused on consumer options. Though it cannot force member banks to adopt the practices, the federal agency provides templates to show members how the product works and the benefits the financial institutions and their communities can gain.

In 2008, the FDIC launched its small-dollar loan pilot program, a two-year trial that set the maximum annual interest rate at 36 percent, with at least a 90-day term. Low or no origination and other fees were to be charged, and participating banks were to streamline the application. Education and savings components had to be included as well.

Twenty-eight banks participated in the pilot, and several retained the credit products. Mississippi-based BankPlus was among them. Its CreditPlus program offers a maximum loan of $1,000 for 12 or 24 months and an APR under 6 percent.

The FDIC conducted its model safe accounts pilot in 2011 to lead banks to serve unbanked and underbanked individuals, targeting low- and moderate-income households. While the template concentrates on transactional and savings services, it includes a short-term, small-dollar loan feature, as well.