Last December, Missouri’s Camp Barnabas announced two major donations within days of each other.

First, the Christian camping ministry with locations in Purdy and Shell Knob received a donation from American professional golfer Jordan Spieth through his Jordan Spieth Family Foundation. According to a press release, the donation would fund 100 campers to attend Camp Barnabas, which provides camping experiences for campers with special needs and chronic illnesses, as well as for their families.

First, the Christian camping ministry with locations in Purdy and Shell Knob received a donation from American professional golfer Jordan Spieth through his Jordan Spieth Family Foundation. According to a press release, the donation would fund 100 campers to attend Camp Barnabas, which provides camping experiences for campers with special needs and chronic illnesses, as well as for their families.

Two days later, Texas Rangers pitcher Cole Hamels and his wife, Heidi, gifted their 32,000 square foot home and more than 100 acres of land on Table Rock Lake to Camp Barnabas — the largest donation the charity had ever received.

“This is so much more than a beautiful property,” said Krystal Simon, chief development officer for Camp Barnabas, in a press release. “This incredible gift allows us to further our ministry and truly change thousands of lives for years to come.”

Camp BarnabasThe Hamels said the mission of Camp Barnabas, to change the way the world sees disability ministry, motivated their gift.

Camp BarnabasThe Hamels said the mission of Camp Barnabas, to change the way the world sees disability ministry, motivated their gift.

“There are tons of amazing charities in Southwest Missouri,” Cole Hamels said in a news release. “Out of all of these, Barnabas really pulled on our heartstrings. Seeing the faces, hearing the laughter, reading the stories of the kids they serve; there is truly nothing like it. Barnabas makes dreams come true, and we felt called to help them in a big way.”

Big donations to charity tend to get a lot of attention. Billionaires Warren Buffett, Bill and Melinda Gates, the Walton family of Walmart — all are among the top philanthropists in the world. When they contribute to projects, those projects make headlines.

But most giving is local, according to “Giving USA 2018: The Annual Report on Philanthropy for the Year 2017,” a publication of Giving USA Foundation that analyzes charitable giving data in the United States. According to the “Giving USA” report, giving by private foundations totaled approximately $66.90 billion in 2017. But giving by individuals during the same time frame was more than four times that — some $286.65 billion.

Donors gave to churches and ministries, universities and educational efforts, and human services agencies. They gave to promote health-related initiatives, arts and culture, and environmental awareness. They gave money, as well as donations of food and clothing. And most of them gave because they believe in the organizations and the causes made possible by their gifts.

“Studies consistently show that people do not give to charity because of the charitable deduction,” said James Preston, assistant executive director for gift planning and regional advancement at the University of Missouri. “There’s a percentage who do, but it’s small. The majority of people who give to charity, who give to their church, do so because they believe in it. They support it. It’s a passion for them.”

James PrestonThat is one reason Preston is hopeful the federal Tax Cuts and Jobs Act passed by Congress and signed by President Donald Trump in December 2017 will have a neutral effect on charitable giving. Still, there is uncertainty about the impact of TCJA.

James PrestonThat is one reason Preston is hopeful the federal Tax Cuts and Jobs Act passed by Congress and signed by President Donald Trump in December 2017 will have a neutral effect on charitable giving. Still, there is uncertainty about the impact of TCJA.

Preston does not expect much change in giving this year, but he is not sure what might happen in 2019 after taxpayers file their 2018 taxes and see the full impact of the law’s changes on personal income taxes.

“Most of us who are watching these things are waiting to see because we don’t know how people will react,” Preston said.

Changes to the Tax Code

Though the TCJA made changes to corporate tax rates, the most significant changes of the law for the average taxpayer relate to personal income taxes. Here are three major changes:

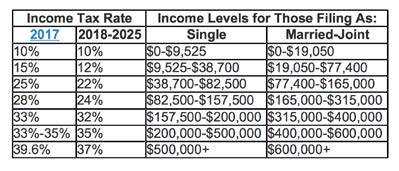

- The law keeps the seven income tax brackets that were in place but lowers tax rates within those brackets. For example, the income tax rate for a single filer earning $38,700-$82,500 would have been 25 percent in 2017. In 2018, the rate will be 22 percent. (See the income tax rate chart below for additional brackets and rates.) Many employees have seen this reflected in the change in withholding rates from their paychecks since February 2018.

- Personal exemptions are eliminated. Before the TCJA, taxpayers subtracted $4,150 from income for each person claimed. That is gone, which means families with many dependents could pay higher taxes despite the higher standard deductions.

- The standard deduction in 2018 is nearly double what it was in 2017. For single filers, the standard deduction increases from $6,350 in 2017 to $12,000 in 2018. The deduction for married and joint filers increases from $12,700 to $24,000.

The Tax Cuts and Jobs Act The law keeps the seven income tax brackets that were in place but lowers tax rates within those brackets.

The Tax Cuts and Jobs Act The law keeps the seven income tax brackets that were in place but lowers tax rates within those brackets.

Itemized deductions, such as those for retirement savings, student loan interest, and medical expenses are still in place. So are deductions for charitable giving, and, in fact, the charitable giving deduction limit is now 60 percent of adjusted gross income, up from 50 percent in 2017.

That is why it is important for taxpayers to continue to keep track of receipts for potential deductions, Preston said.

“The law did not change the receiving requirements that charities (including churches) have,” he said. “People will still get a receipt for their giving each year, and some may get to the end of the year and realize they still need to itemize.”

However, the increase in the standard deduction means most donors will not give enough to exceed the standard deduction. As a result, their incentive to itemize deductions for charitable contributions, offerings and mortgage interest will be gone. That change is the one that concerns churches and charities, but it may be 2019 before the full impact is known. Preston is hopeful it will not be an issue.

“We’re predicting it won’t make much difference when it comes to churches because most churchgoers are going to support their church whether they get a charitable deduction or not,” he said. “Some even project that people may be able to give more because they are getting a bigger deduction than they used to get.”

Planning for the Future

That does not mean that proponents of the charitable giving deduction have forgotten the concerns of churches, ministries and other organizations that depend on these gifts. Moves are already underway to separate the charitable deduction from the IRS’s Schedule A form, which is used to report itemized deductions.

Also, some tax experts are recommending that clients consider “bundling” gifts, essentially giving two year’s worth of contributions every other year in order to exceed the standard deduction threshold, then taking the standard deduction in alternate years. Though bundling could be beneficial to givers, it also could make budgeting a challenge for gift recipients that need regular cash flow to operate.

Preston said it might be helpful for givers who bundle donations to let their church or organization know that’s what they are doing so the organization can plan ahead for the next year when the gift would not be coming.

“It would be good for ministry organizations if churches would have that conversation,” Preston said.

Angela Barker JacksonThe future of church fundraising and budgeting will require reimagining for this present age but not just because of tax policy, said Angela Barker Jackson, who directs the money and ministry program at Central Baptist Theological Seminary in Shawnee, Kan.

Angela Barker JacksonThe future of church fundraising and budgeting will require reimagining for this present age but not just because of tax policy, said Angela Barker Jackson, who directs the money and ministry program at Central Baptist Theological Seminary in Shawnee, Kan.

“While pledging to an institutional budget may have garnered necessary financial resources in the past, today’s churchgoers and givers, including the ‘nones,’ are not looking to support institutions but real-world mission and impact they can witness,” Jackson said. “Thus, leaders of churches and other faith-based organizations must be clear and compelling in telling the story of their institution and its connection to gospel work in the world.”

Jackson said some churches and ministries are transitioning to “narrative budgets,” focused on telling stories of what donor dollars are doing and will do rather than listing line items in a spreadsheet. Such an approach is effective but requires imagination and intentionality, she said.

“It cannot be relegated to one Sunday a year for the stewardship drive,” she added.

In her research into formation for financial leadership, Jackson uncovered “courage” as the number one tool faith leaders must utilize when navigating a landscape of economic ups-and-downs, changing tax policy and dramatic shifts in religious affiliation across the United States.

“An uncertain financial landscape,” she explained, “certainly calls us to nurture courage in ourselves as leaders and in our organizations as we seek to fund God’s mission in the world and to be faithful in managing the resources we’ve been entrusted.”

Carrie Brown McWhorter writes for several publications, including The Alabama Baptist newspaper and Missions Mosaic magazine. Find her on Facebook @McWhorterMedia or visit her website, carriebrownmcwhorter.com.

See also: