Months after Southwestern Baptist Theological Seminary in Fort Worth, Texas, accused its former president Paige Patterson of stealing from the school, a newly-released financial report offers more insights into the case. The 2019 990 form from the Sandy Creek Foundation, the personal nonprofit of Paige and Dorothy Patterson, offers clues into their spending and connections to the Conservative Baptist Network.

SWBTS alleged in its report published May 28 in the 2021 Southern Baptist Convention Book of Reports that after Patterson’s termination, “the Pattersons had improperly removed boxes of documents that belonged to the Seminary from the President’s Home” including “confidential donor information, student records, institutional correspondence, financial records, historical files, and meeting and Convention records.” Most significantly, SWBTS claimed the Pattersons “undertook a scheme” to “contact Seminary donors to divert donations and gifts away from the Seminary.” SWBTS specifically noted a $5 million gift to the school that was revoked and instead given to the Pattersons’ nonprofit.

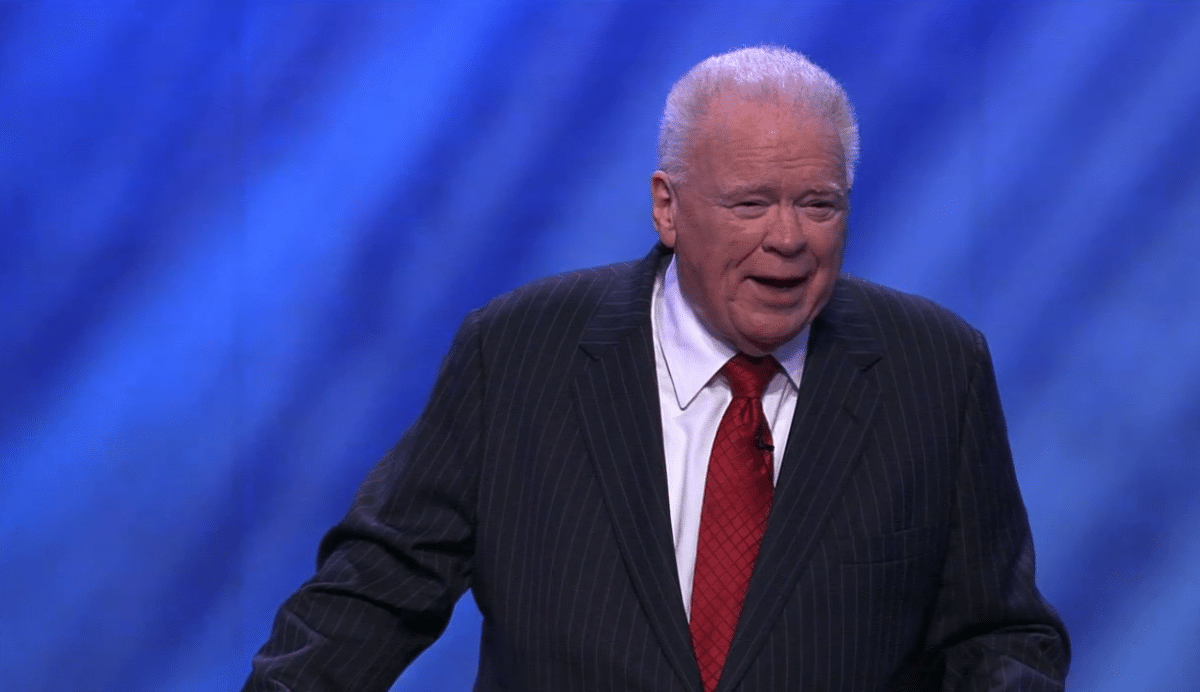

Screengrab as Paige Patterson preached at First Baptist Church in Dallas, Texas, on May 30, 2021.

Word&Way first reported that the 2018 990 form from the Sandy Creek Foundation matched SWBTS’s allegations. While the foundation started 2018 with just $82,292 in net assets, it ended that year with $5,295,210 in net assets. Most of that growth occurred in the “unusual grants” category where the foundation reported $5,396,227 after years of nothing in that area.

A Word&Way analysis of the newly-available 2019 report show the significance of that $5 million gift for the Pattersons. Without that contribution, the Sandy Creek Foundation wouldn’t have the funds to provide salaries and other payments for the Pattersons.

In 2019, the foundation only received $490,441 but spent $1,067,729, creating a deficit of $454,249. Without the $5 million grant in 2018, the foundation wouldn’t have had the resources to cover that level of spending in 2019.

Those expenses in 2019 included salaries for Paige ($60,000), Dorothy ($40,000), their son Armour ($9,000), and Paige’s longtime assistant Scott Colter ($79,083). The foundation also employs other staff who aren’t directors and thus aren’t listed on the IRS reports. But the total salaries and benefits for all the employees is listed as $397,490. According to the foundation’s Paycheck Protection Program loan approved in April of 2020, the organization was seeking $63,100 to cover eight weeks of salaries for seven jobs. The loan was later forgiven.

In addition to salary and benefits for the Patterson and others, the Sandy Creek Foundation pays for other expenses incurred by the Pattersons. This includes $14,499 in automotive expenses and $11,080 for “theological research.” The foundation also listed office expenses ($16,447) and spending for occupancy ($70,154), the latter of which for the IRS refers to expenses for office space or other facilities. The foundation claims as its office the million-dollar home the Pattersons purchased in 2018 after being removed from SWBTS. The school referenced the home in its allegations against the Pattersons earlier this year.

The Pattersons are trying to get out of paying the property tax, claiming the home should be covered by the foundation’s nonprofit status. They urged supporters to pray about this as they are “on our knees concerning the refusal of Collin County to honor our non-profit status, resulting in hefty property tax bill as well as penalties during process of appeal.” According to the tax assessor collector for Collin County, Texas, this year’s property tax bill is $24,891.46. The foundation is listed as owning the home, which has an assessed tax value of over $1.2 million.

After SWBTS’s allegations in May, Patterson claimed a “lynch mob” was “out there trying to get hold of me.” He also acknowledged for the first time his involvement in the launch of the Conservative Baptist Network that is attempting to shift the SBC further rightward. Patterson admitted that his new home — the one owned by his foundation — served as the setting for the initial promotional videos. He also said he attended a CBN event later that year. The 2020 financial reports from the Sandy Creek Foundation aren’t yet publicly available, but the 2019 records show the foundation paid $204,328 for travel expenses.

Colter, who was paid by the foundation in 2018 and 2019, was listed on the initial Steering Council of CBN as executive director of the Sandy Creek Foundation. The spokesperson for CBN since its launch has been Brad Jurkovich, who is listed as a director for the Sandy Creek Foundation in both 2018 and 2019. Also included as a Steering Council member is Chris Thompson, a pastor in North Carolina who joined the Sandy Creek Foundation board in 2019.