(RNS) — When the Rev. Carieta Cain-Grizzell reached age 75, she had expected to retire after a lifetime as an African Methodist Episcopal Church member who became a pastor of several of its churches.

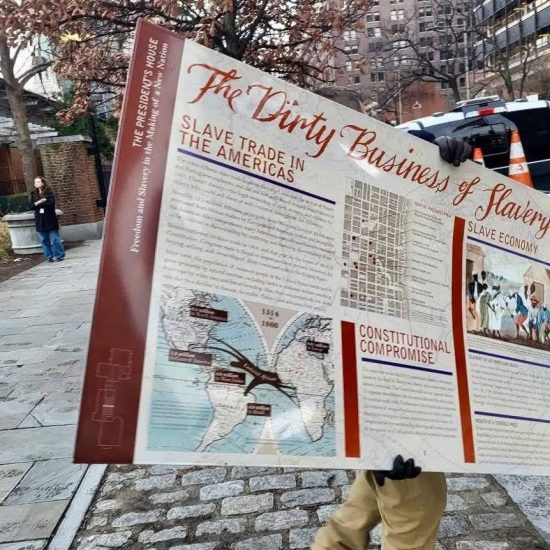

The opening of the African Methodist Episcopal Church quadrennial General Conference on Wednesday, Aug. 21, 2024, in Columbus, Ohio. (Video screen grab)

Instead, the Washington, D.C., native-turned-Californian is now “on loan” to the United Methodist Church, first pastoring a Fair Oaks congregation and recently appointed to one in Oakland.

“Pastoring is my ministry,” said Cain-Grizzell, whose lineage in the historically Black AME denomination traces back five generations. “It was something that I wanted to do,

although I had to do it even if I didn’t want to do it.”

Cain-Grizzell is one of thousands of pastors, elders, and staffers of the AME Church who lost substantial portions of their retirement savings due to an alleged mishandling of the accounts. A class action lawsuit filed in 2022 against the church calculated the total loss at $90 million. As of Wednesday (Aug.21), church leadership has not revealed a clear path to restore the funds.

The Rev. Carieta Cain-Grizzell. (Courtesy photo)

As the AME Church opened its weeklong quadrennial General Conference on Wednesday in Columbus, Ohio, people like Cain-Grizzell questioned how the fallout from the financial crisis might be addressed at the meeting, which concludes on Aug. 28.

In the first business session of the conference, the church’s general counsel gave an update on the investigations and litigation related to the “legacy retirement plan” and there was an “intense debate” between two bishops as the Department of Retirement Services was discussed, reported The Christian Recorder, the church’s official publication.

Douglass Selby, the church’s attorney, said the church has been treated as a victim rather than a subject of investigations by the U.S. Justice Department and the Securities and Exchange Commission.

“The AME Church is objectively in a much stronger position in liability than 12 months ago,” he said, according to The Christian Recorder.

The bishops debated how money might be restored to plan participants, with one seeking a route that did not increase the denomination’s debts and another aiming to protect its legal strategies, the newspaper reported.

A third bishop, who co-chairs the retirement services commission, said plan participants who have expressed concerns would have a first-time “full briefing” in an Aug. 30 webinar.

As of Thursday, 2,100 delegates were attending the gathering of the denomination that dates to 1816.

At the opening worship service, the litany on the meeting’s theme — “The Pandemics, The Promise, The Plan” — spoke of division in the AME Church’s ranks.

Bishops process in during the opening of the African Methodist Episcopal Church quadrennial General Conference on Wednesday, Aug. 21, 2024, in Columbus, Ohio. (Video screen grab)

“We confess that our fellowship has been fractured,” read Bishop E. Anne Henning Byfield. “Some feel betrayed and injured, a circumstance with the potential to tear us apart, fragmented and feeble. Was the Vision given to our venerable founder merely myopic?”

The response in the litany for other worshippers was: “A thousand afflictions to vex our souls, yet we are the Church, we are called to Hope.”

Later on the first day of the General Conference, the church’s AME bishops released their quadrennial episcopal address, a summation and commentary on what had occurred within and outside the denomination since their last meeting — including the retirement issues.

“Investigating the retirement department has resulted in the need to rebuild trust from the church’s stakeholders — both laity and clergy,” they said. “Although we have developed a new plan that charts a new path and provides more transparency, the future of the AME Church will also depend on our ability to incorporate responsible leadership strategies that will hold the church’s entire infrastructure accountable.”

They added: “The church should explore why some clergy have left the ministry for various reasons beyond retirement security.”

Among the possible actions they suggested were “financial planning workshops for clergy members, exploring flexible retirement options, and establishing a support network for retired clergy to address their evolving needs.”

Truist Bank, one of the sponsors for the meeting, is offering workshops on “Banking & Budgeting Basics” during the conference.

Some 2,900 people have joined an “AMEs for Reform” Facebook group and others have issued open letters as part of “AMEs for Justice and Accountability.” They are among those asking how the church will live up to its goal of “making participants whole” after many were left with only an estimated 30% of their money in their accounts.

The Rev. J. Edgar Boyd, a leader of the group calling for accountability, spoke in an interview about the sacrifices of ministers whose sole income was from the church.

Boyd, the retired senior pastor of First African Methodist Episcopal Church in Los Angeles, said the clergy were “hoping that when they retired that money they put in during the green season of their ability would be now something to help them in the dry season of their retirement — and they get to retirement and it’s not there.”

The Rev. Jerome V. Harris. (Photo © AME Church)

The Rev. Jerome Harris, who resigned in 2021 after 21 years, was the head of the denomination’s Department of Retirement Services. Harris died suddenly in May of a heart attack, according to a church official. At the time of Harris’ death, he, along with others, remained the subject of class-action litigation filed in 2022 by retired pastors, accusing the church of mishandling the pension funds.

“Plaintiffs and the church met to mediate a potential settlement but have not yet reached agreement,” a spokesperson for AARP Foundation Litigation, which is assisting with the litigation, said on Friday.

The AME Church sued Harris after an independent investigation claimed that he and others embezzled money from the retirement accounts.

Cain-Grizzell, who retired in September 2021, said she recalled Harris speaking at the AME Church General Conference, which usually meets once every four years, of his accomplishments as he concluded his work.

“He was retiring, and at his retirement at the General Conference, he was making this glorious report about all that he had done,” she said.

Shortly before her own retirement, Cain-Grizzell, now 78, said, she received a letter from his successor announcing to annuity plan participants that a forensic audit was being conducted and distributions would be halted.

“That was my first knowledge that something was wrong,” she said.

Later, she received about 30% of the amount she had originally hoped to use in retirement.

“But, of course, I’m not satisfied with that,” said Cain-Grizzell, who continues to work, in part because she is paying down educational loans. “I’m still looking to receive the balance of that 70%.”

The Rev. James F. Miller, now the executive director of the Department of Retirement Services, has issued a report discussing how a new program is bringing an average return of 8% on current investments.

But writing in an article in The Christian Recorder, Miller acknowledged there is work to be done for restoration of the missing 70% of the old program’s funds.

“The responsibility for accomplishing this is in the hands of other church leadership,” he wrote. “Personally, I hope the Lord will reveal some acceptable answer to this, because my wife and I put most of our life savings into the fund and now our future, even our present, has been affected and altered by what happened.”

Other longtime AME members also are waiting.

Sandra Womack Johnson, the recent widow of the Rev. Walter Johnson Jr., said her husband had served the AME Church for 45 years, most recently pastoring a Chicago church for 13 years, and was recognized for his community leadership. When he became ill several years ago, she said, she learned the amount of her husband’s annuity had dropped precipitously.

“I want a check,” said Womack Johnson, who buried her husband on Saturday. “Talk is just talk. We need resolution. You know, people have needs. I should be able to get my husband’s resources and do whatever I need to do for our family.”